What is a Cost Segregation Study?

Cost Segregation Study is a strategy used by many successful commercial real estate owners to find “hidden dollars” within the walls of their building! Commercial buildings are subject to a standard 39 year depreciation schedule for tax purposes (27.5 years for apartment buildings). An Engineering-Based Cost Segregation Study is an IRS approved method to identify the various components of a commercial property, and reclassify them to a shorter depreciation schedule of either 5, 7, or 15 years. This results in a substantial cash-flow benefit for the owner, of approximately $70,000 for every $1 million in building cost.

Cost Segregation does not change the total depreciable amount of the building cost, rather it accelerates a portion of the total depreciation into the shorter time periods. Hence, it is also referred to as “accelerated depreciation”. The reason this partial acceleration results in a substantial benefit for the owner is a result of a principle known as “Time Value of Money”, which simply means that a dollar today is worth more than a dollar tomorrow. Capturing eligible tax deductions sooner rather than waiting 39 years, provides the building owner with a cash-flow benefit that would not be possible without conducting a Cost Segregation analysis. “The major advantage of cost segregation is not necessarily that it will produce more depreciation deductions. Instead, due to the time value of money, the advantage of these front-loaded deductions will be quantifiably greater than had the deductions been spread over longer periods of time using slower depreciation methods.” Journal of Accountancy © 2005 by the AICPA Some examples of building components that qualify for accelerated depreciation include: electrical installations, speciality plumbing, flooring, mechanical components, and finishes.

COST SEGREGATION STUDY RESULTS IN THE FOLLOWING BENEFITS:

- An immediate increase in cash flow

- A reduction in current tax liability

- The deferral of taxes

- The ability to reclaim “missed” depreciation deductions from prior years (without having to amend tax returns)

WHY DO I NEED A COST SEGREGATION SPECIALIST?

– In order to capture the maximum depreciation benefits for new and existing buildings, IRS requires an Engineering-Based Cost Segregation Study. – Most CPA firms lack the necessary engineering expertise in house, and therefore prefer to outsource this task. – A qualified Cost Segregation specialist will provide detailed supporting documentation to meet IRS requirements. In the IRS Cost Segregation Audit Techniques Guide (ATG), Chapter 4, the prime attribute of a high-quality cost segregation study is “preparation by an individual with expertise and experience.” The Audit Techniques Guide adds: “Preparation of cost segregation studies requires knowledge of both the construction process and the tax law involving property classifications for depreciation purposes. In general, a study by an engineer is more reliable than one conducted by someone with no engineering or construction background. Experience in cost estimating and allocation, as well as knowledge of the applicable tax law, are other important criteria.”

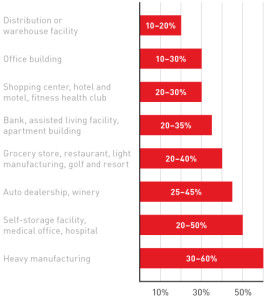

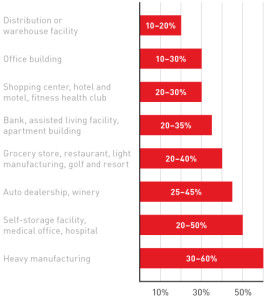

PERCENTAGE OF ACCELERATED DEPRECIATION FROM COST SEGREGATION

WHY CONTACT ACUSOLUTIONS?

– Qualified, Experienced Cost Segregation Engineers!

– Works with all types of commercial properties!

– Fast, Hassle-Free process!

– FREE, No-obligation evaluation to determine eligibility and benefits!

– Full Audit Defense included as part of the service!

– Nationwide Service!

DO YOU OWN A COMMERCIAL PROPERTY OR AN APARTMENT BUILDING?

Ask yourself the following: – Was the purchase price of the building over $1 million? – Did you assume ownership within the last 15 years? If so, contact us today to get a FREE, No-Obligation, evaluation to determine if Cost Segregation is right for you. Our analysts will prepare a proposal and calculate your potential benefits at no cost to you! SUCCESS EXAMPLES